Open topic with navigation

(continued from Price Codes)

Taxes

Taxes can be defined which are then used to calculate tax values (if any) which may apply to any portion of a service, or to any non-trade creditors or debtors.

|

|

In a Tour Quote or Booking, the tax value is not necessarily the Booking/Quote Total plus tax at nn%. In a Quote or Booking, the Tax is calculated for each component of each service and stated as a total. This means that in some circumstances (e.g., where non taxed or tax exempt services have been used in a Booking/Quote), the tax value of the Booking/Quote would not exactly equate to Booking Price + nn% tax. The tax types defined can also be attached to creditors and debtors, so that if Non Booking invoices are raised in either Payables or Receivables, then Tourplan knows which tax to apply to those Non Booking related transactions.

|

It may not be necessary to set up taxes at all—it will depend totally on the tax regime which exists in the country of domicile. Bed Taxes are a good example, where invoices from suppliers are inclusive of the Bed Tax and the tour operator pays that tax value directly back to the Hotelier, without any accounting liability by the tour operator—in other words, it's a tax which is included in the hotel rate.

As a general rule, if a tax does not have to be accounted for, then there is no need to have it set up; rather it could be included as part of the hotel or service providers cost price. E.g., if a hotel is charging 100.00 and there is a Bed Tax of 2.00 for which there is no accounting responsibility, then the rate can be entered into the Tourplan Product Database as 102.00.

|

|

Having said non accountable taxes do not have to be set up, there is a case to have such taxes set up in the tax table so that it is easier to change prices if the tax rate changes.

Any tax set up or changes to taxes should be discussed with the nearest Tourplan Support office.

|

|

|

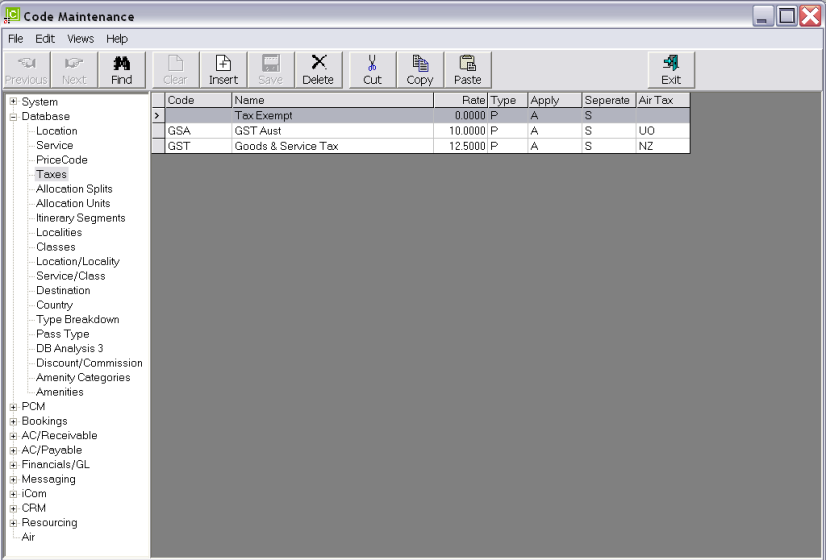

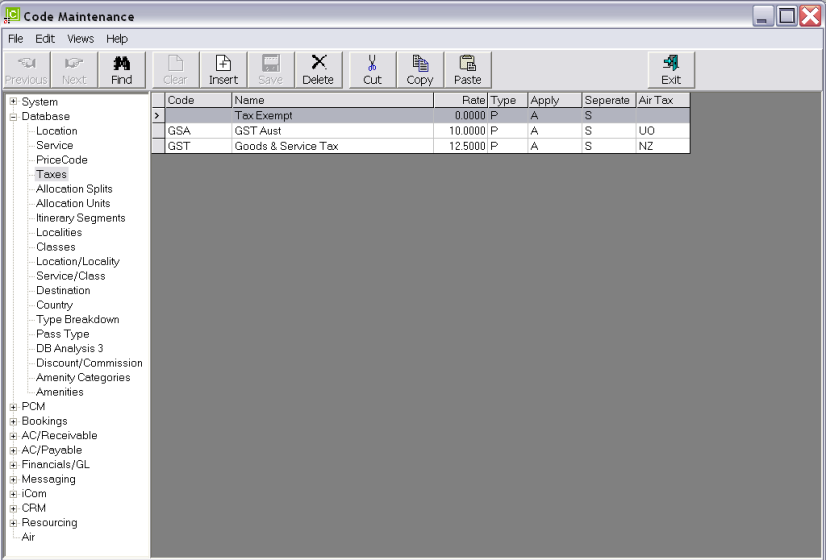

On initial entry to the Taxes node, any existing records will display.

|

Screen Shot 33: Taxes Scroll

|

|

The column headings at the top of the scroll are the only column headings available in this screen.

|

|

|

Tax Codes cannot be changed. Taxes cannot be deleted if they have been used in a service in the Product Database, a Quote, Booking or attached to an Agent or Supplier.

|

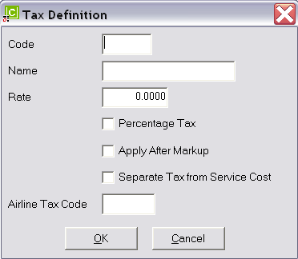

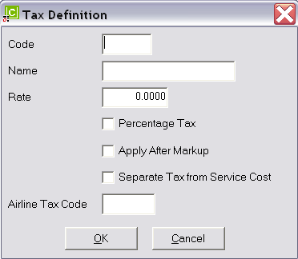

To create a new Tax, click the Insert button in the button bar.

Screen Shot 34: Taxes Dialogue

Code (3 Chars)

A code to describe the tax.

Name (30 Chars)

A long description of the tax.

Rate (Numeric 10.4)

The numeric value of this tax. The rate can be either a percentage type figure or a flat rate monetary figure, as required. The indication whether it is (F)lat or (P)ercentage is determined in the next field.

Percentage Tax (Checkbox)

This entry will determine how the system interprets the Rate value. If the rate entered is a percentage, check this box. If the rate entered is a Flat ($) figure, leave this box unchecked.

|

|

If the value in the rate field is 10.0000, and the Percentage Tax checkbox is checked, then the system interprets the tax as 10.0000%. If the checkbox is unchecked, it is interpreted as $10.00.

|

Apply After Mark-up (Checkbox)

This entry will determine whether the system applies the tax to a Service Cost before or after mark-ups are applied. Check the box if tax applies to the marked up (gross) amount.

|

|

If a mark-up is applied to a service in the Product Database, the following is the effect of this checkbox setting. Assume tax at 10.0000%.

Database Cost: 100.00 Database Sell 120.00.

Unchecked–Tax value will be 10.00

Checked–Tax value will be 12.00 (this is the standard setting for input/output tax systems).

|

Separate Tax From Service Cost (Checkbox)

This will determine how the system handles "Non Accountable" taxes. In some countries where there may be differing State/Provincial Taxes apply as well as an Input/Output Tax, then the State/Provincial Taxes are set up with this box unchecked, and the Input/Output tax is set up with the box checked.

This has the effect of applying the State/Provincial Tax to the costs, as well as applying the Input/Output tax to the cost, but ONLY the Input/Output component is stripped out for accounting purposes.

It is normal where State/Provincial taxes are incurred that they are billed to the tour operator by the Service Provider, and therefore as discussed above, may not necessarily be set up as a tax—rather, include the tax in the rates in the Product Database. If it is necessary to set the taxes up separately, then as an example, assuming that a State/Provincial Tax of 10% applies on Room Rates only and that a 10% GST applies to all components of the service (and all other Services) and that the Rate is $100.00. In this scenario, the TOTAL Tax amount is $20.00 ($10.00 State and $10.00 GST).

|

|

One tax is not applied on top of the other; the system does not take the 100.00, add the 10% State Tax for a sub total of $110.00 and then add the 10% GST which would make the Total $121.00.

|

Airline Tax Code (2 Chars)

|

|

This field is only used in conjunction with the Tourplan flightConnect External Service.

|

By and large, airline taxes are not accountable taxes. Airline taxes are generally the surcharges (fuel), Government and Airport charges that are levied. These are identified in the Tax fields of an airline ticket and are normally shown as an amount followed by a 2 character code—e.g., 60.80WY, 8.00WG, 59.00AU. The 2 letter codes mean something and in this example they are:

|

WY

|

Australia Passenger Service Charge–Intl

|

|

WG

|

Australia Safety and Security Charge ((Intl) & (Dom))

|

|

AU

|

Australia Passenger Movement Charge (PMC)

|

In some instances, the Airline taxes are accountable taxes—e.g.

|

UO

|

Australian GST

|

|

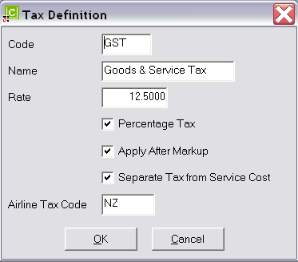

NZ

|

New Zealand GST

|

|

FJ

|

Fiji VAT

|

Where a) the Tourplan user company is using flightConnect and b) the tax is accountable by the tour operator, the Airline Tax Code must be entered against the applicable accountable tax.

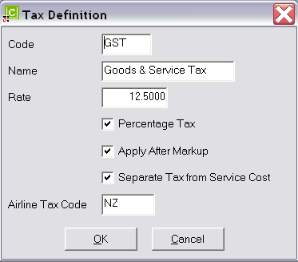

Screen Shot 35: Sample Completed Tax Dialogue

OK

Click the OK button to save the Tax definition.

Cancel

Click Cancel to cancel setting up the Tax Definition, or to return to the scroll.

(continued in Allocation Splits)

Open topic with navigation