This transaction type enables previously received, but unallocated cash to be applied against an invoice.

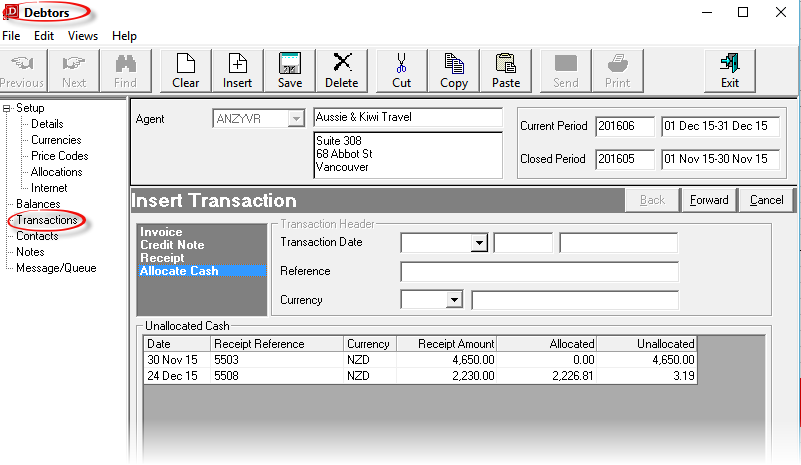

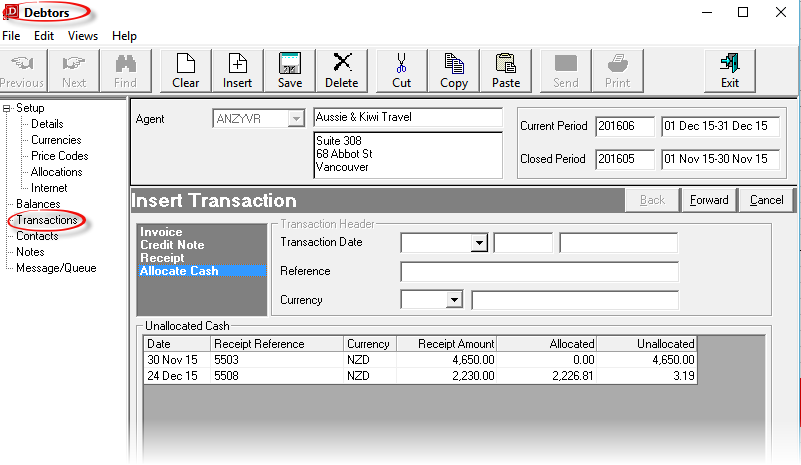

When Allocate Cash is selected from the Insert Transaction screen, any existing unallocated receipts are displayed.

Screen Shot 68: Allocate Cash Transaction Header

|

The column headings at the top of these scrolls are the only column headings available in this screen. |

|

The Transaction Header details are display only and cannot be altered. |

To allocate cash, click on the receipt in the scroll that is to be applied. The receipt details will populate the Transaction Header area of the screen.

|

Click the Forward Button on the Wizard Bar to continue. The Receipt screen will display. |

|

Click the Cancel Button to cancel the Receipt. |

There are two possible scenarios when allocating unallocated cash:

Although the processing the allocation of cash is the same in both cases, slightly different screen layouts can be presented.

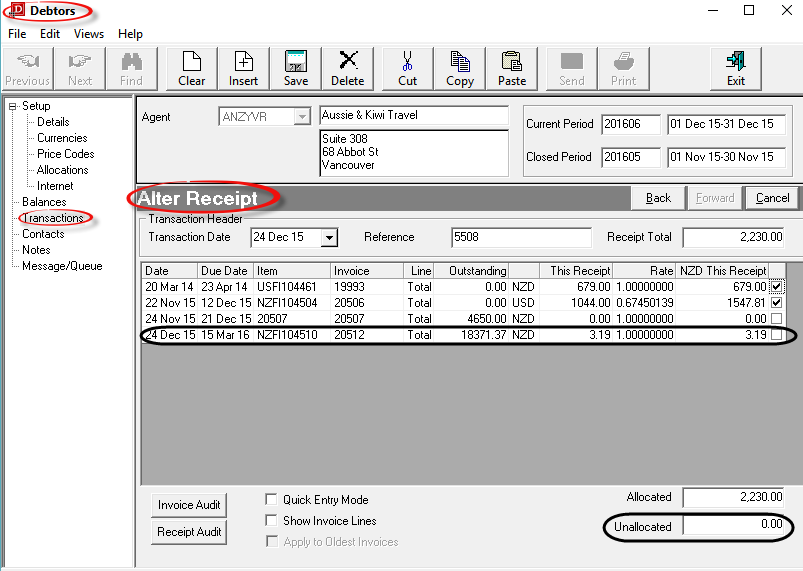

When the allocation of cash is taking place in an open accounting period, the process is effectively 'Altering' the existing receipt

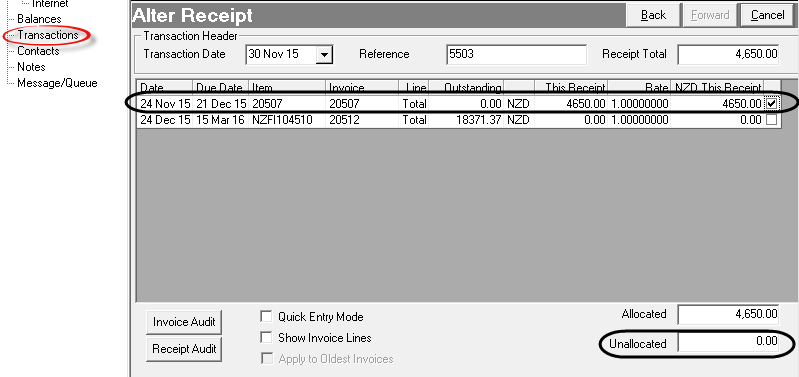

Screen Shot 69: Allocate Cash – Alter Receipt

|

Screen Shot 69 Allocate Cash – Alter Receipt displays Receipt 5508 and the full receipt values applied to date. Editing of these values is allowed. This is because this unallocated receipt is in an open period so can be altered. |

This is the same screen as seen in Screen Shot 55 New Receipt – Applied Amounts, and the completion of the detail is the same. The residual balance on Receipt 5508 of 3.19 has been applied to Invoice 20512.

|

When finished, click the Save button on the button bar to return to the Transaction list screen. |

|

If any item on previous screens need correcting, use the Back button on them Wizard bar. |

|

To cancel, click the Cancel button on the Wizard bar. |

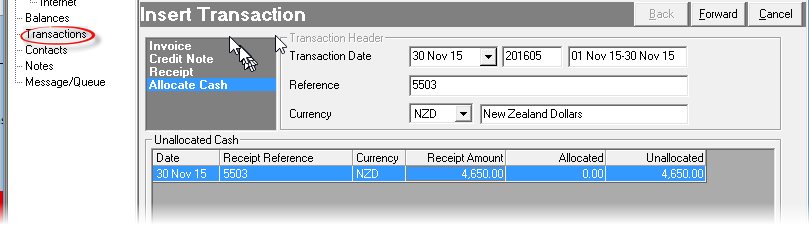

When the allocation of cash is being made on an Unallocated receipt that is in a closed accounting period, the screen that displays will depend on whether any portion of the receipt was allocated in the now closed accounting period, or if the total amount of the receipt was unallocated.

Screen Shot 70: Allocate Receipt From Closed Period – Header

Receipt 5503 shown in Screen Shot 70 Allocate Receipt From Closed Period – Header was issued in (the now) closed period 201605. This receipt can still be allocated.

Screen Shot 71: Allocate Receipt From Closed Period – Lines

As the Unallocated Receipt selected in Screen Shot 70 Allocate Receipt From Closed Period – Header is in a closed accounting period, only the unallocated value of the receipt will display—those lines that may have already been applied in closed periods are unable to be accessed.

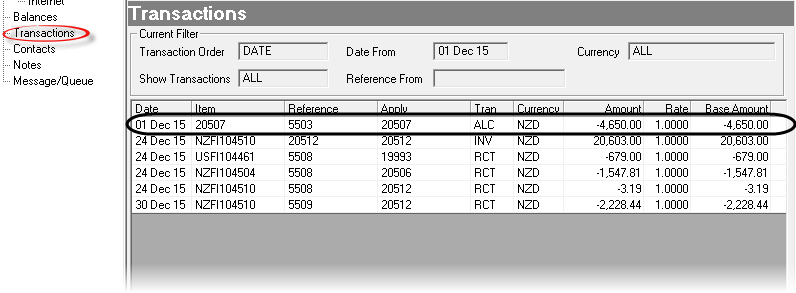

Screen Shot 72: ALC Transaction Line

When an Unallocated Receipt from a closed period is allocated, a new ALC transaction is created dated the first day of the current debtors accounting period.

|

Where cash is allocated to an unallocated receipt which is in an open period, the transaction type is RCT (Receipt). When the unallocated receipt is in a closed period, the transaction type is ALC (Allocated Cash) and cannot be altered. |