Open topic with navigation

Introduction & Overview

Accounts Training Guide 1 details the setting up and use of the three Tourplan accounting applications - Debtors (Agents), Creditors (Suppliers) and the General (Nominal) Ledger.

|

Tourplan Accounting can be implemented at various levels - from the very basic (i.e., Booking Invoices only - no Debtors receipting or Accounts Payable or General Ledger) through to the whole suite. This training guide deals with the setting up and use of all three applications, regardless of the system implementation level.

|

Accounts Training Guide 2 covers the periodic accounting processes that need to be performed - e.g., Agent Commission Payments, Supplier Pre-Payments, Cheque/EFT payment processing, Accounting Period Ends, Bank Reconciliation etc.

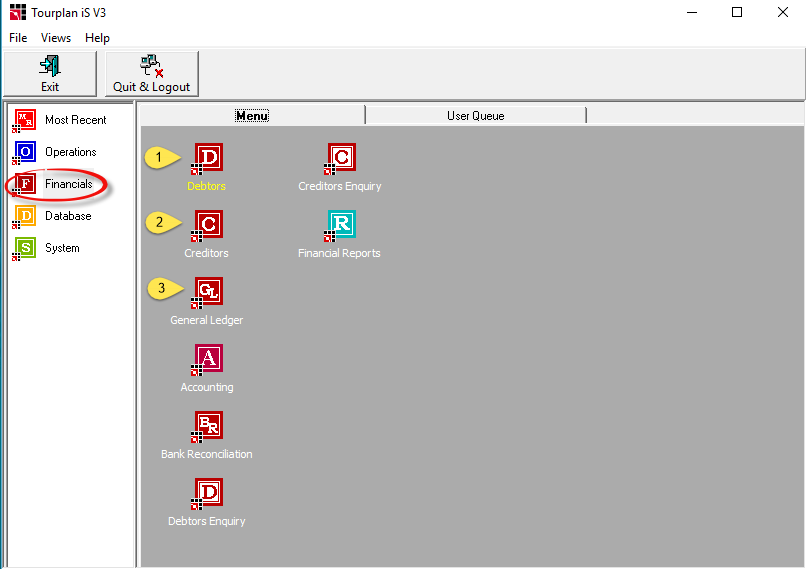

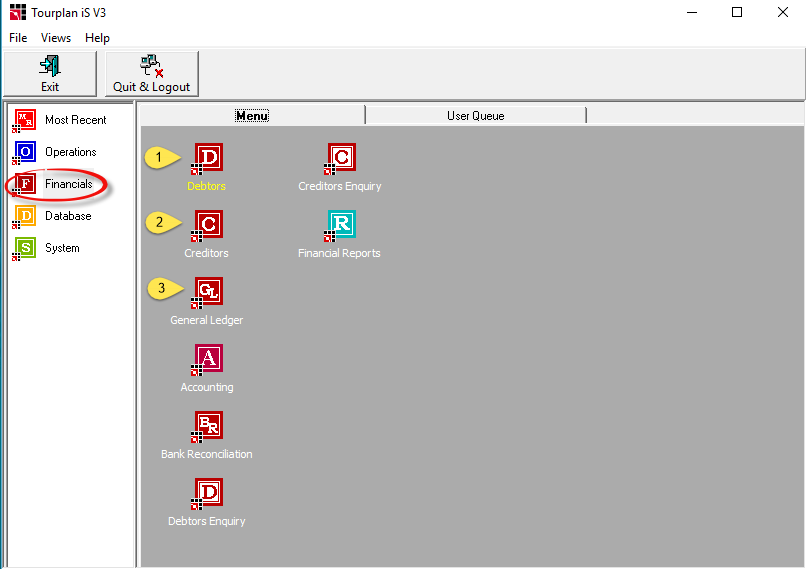

The 3 Tourplan Accounting applications are accessed from the Financials Menu:

Debtors: for adding and changing agent details and entering agent transactions such as receipts, Credit Notes and non-booking invoices.

Debtors: for adding and changing agent details and entering agent transactions such as receipts, Credit Notes and non-booking invoices.

Creditors: for adding and changing supplier details and entering supplier transactions such as invoices, Credit Notes and payments.

Creditors: for adding and changing supplier details and entering supplier transactions such as invoices, Credit Notes and payments.

General Ledger: for setting up the chart of financial accounts, viewing account balances and inserting transactions.

General Ledger: for setting up the chart of financial accounts, viewing account balances and inserting transactions.

Screen Shot 1: Tourplan Financials Menu

Training Guide Document Conventions

|

Indicates important information

|

Field Name/ Screen Name in this font

Relates to an on screen field, button or text. Shows the Field Name, Field Type and Field Length (if applicable).

Checkbox

A box which can be clicked (checked) to indicate true, or uncheck to indicate false

Radio Button

A choice made by clicking the label or button.

Dropdown.

A list of pre defined codes/choices accessed by clicking the down arrow

Button

An elevated on screen button that can be activated by clicking it

Tabs

Search

An elevated on screen button with the … symbol indicates that a search can be performed by clicking the button.

Multi Select List Box

A list of checkboxes of which all or some can be selected

Spin Control

Values can be entered manually or the spin arrows can be used to locate the required value.

|

Date

|

Of Following Month

|

| |

Of Current Month

|

Dropdown or Radio Button field name(s), list descriptions etc are in this format and display available options or explanation.

A screen shot that fades at the bottom of the shot indicates that the screen shot has been clipped, without losing any detail.

Tourplan Accounting Terminology

These are the key principles and associated terminology used in this document. It should be noted that System INI values pertaining to Debtors, Creditors and General Ledger Period settings will impact on the frequency or use of some of these items.

|

Accounts Payable

|

Contains all supplier transactions. Also known as the Creditors Ledger or Purchases Ledger.

|

|

Accounts Receivable

|

Contains all agent transactions. Also known as the Debtors Ledger or Sales Ledger.

|

|

AGP

|

Each Tourplan financial transaction has an Age Period (AGP) which determines which financial period in either the AR or AP ledger the transaction will be posted to—i.e., which column in the debtors or creditors ledgers Aged Trial Balance the transaction will appear in.

|

|

Closed Period

|

Any accounting period which has been finalised and "closed". Closing the period will prevent transactions from being dated in, or posted to that, or any prior, period. Each ledger has its own Current & Closed periods.

|

|

Closed Transaction

|

Any invoice transaction that has been fully paid/receipted and all components of which are now in a closed accounting period.

|

|

Current Period

|

The accounting period in which the system is currently operating. Each ledger has its own Current & Closed periods.

|

|

Date of Travel Accounting

|

A method of accounting whereby all transactions posting to the General Ledger are dated relative to the booking's (to which they apply) travel date.

|

|

Future Aged

|

An accounting transaction dated in, or prior to, the current accounting period, but whose AGP is greater than the transaction period.

|

|

Future Cash

|

Any case where cash has been received/paid and the transaction is dated prior to the age period of the invoice against which it applies.

|

|

Future Entered

|

An accounting transaction dated in a period greater than the current accounting period.

|

|

Future Expenses

|

Expenses (AP Invoices) that have been processed prior to a tour travelling.

|

|

Future Revenue

|

Revenue (AR) Invoices that have been raised in advance of the current General Ledger Period. Typically occurs when Tours have been invoiced a month or more prior to travel.

|

|

General Ledger

|

The accounting ledger where transactions from the Debtors and Creditors ledgers are consolidated. Also known as the Nominal Ledger.

|

|

GLP

|

Each financial transaction in Tourplan has a General Ledger Posting period (GLP) which determines which financial period in the General Ledger the transaction will be posted to.

|

|

Item

|

A collection of transactions relating to a single booking and identified by Tour Reference. For non-booking transactions, the Item is the original Invoice reference.

|

|

Open Period

|

Any period later than the closed period. This will include, but is not limited to the current period.

|

|

Open Transactions

|

Any accounting transaction that has not yet been fully paid/credited.

|

|

Outstanding Vouchers

|

Any voucher that has been issued and for which a Supplier invoice/s has not been received or the voucher has not been paid and closed. In other businesses/accounting environments this would be an expected/contingent liability.

|

|

Subsidiary Ledger(s)

|

Refers to the Accounts Receivable and/or Accounts Payable Ledgers.

|

|

Tour Reference

|

A unique combination of Branch Code, Department Code and a 6 digit number that is assigned to an accountable booking. This is used to identify and retrieve a booking and to collate transactions into "items".

|

|

Transaction Item

|

A grouping of transactions (invoices, Credit Notes and receipts/cheques) that pertain to the same booking. An Item's (booking) reference will match the Tour Reference.

|

|

TRP

|

Each financial transaction in Tourplan has a Transaction period (TRP). This is usually the current open period of the Subsidiary Ledger (AR or AP) in which the transaction is entered.

|

|

Unallocated Cash

|

Cash Receipts received and banked but for which there is yet to be an invoice raised.

|

|

Voucher

|

A document created from a booking service line that indicates authority to purchase services. Similar to a purchase order in other environments and is an expected liability.

|

Accounting Period Definitions

Tourplan accounting periods are defined in the CodeMaint application under General Ledger > Calendar.

It is necessary to define the number of accounting periods in each accounting year before any Bookings, Agents or Suppliers and accounting transactions can be entered into Tourplan.

Any invoice generation needs to know the accounting period the Invoice is being raised in, the period the revenue/expense is to post to, the period the revenue/expense is to age to and the period of the Date Entered. For this reason, the calendar must be set up as a prerequisite to any use of the system—whether full accounting is being used or not.

The basis of the calendar is the user company’s accounting financial year. The majority of companies account each month—i.e., 12 one month periods in each financial year.

The calendar periods are in the form YYYYNN where YYYY is the Financial Year (e.g. 2017), and NN is the accounting period in that year (e.g. 01). 01 does not refer to January, unless the financial year is a calendar year. Taking the financial year 2017 as an example, the following are the period numbers and dates for the three most common financial year ends:

Table 1: Calendar Periods

|

Period

|

01 Jan–31 Dec

|

01 Apr–31 Mar

|

01 Jul–30 Jun

|

|

201701

|

01-Jan-2017

|

31-Jan-2017

|

01-Apr-2016

|

30-Apr-2016

|

01-Jul-2016

|

31-Jul-2016

|

|

201702

|

01-Feb-2017

|

28-Feb-2017

|

01-May-2016

|

31-May-2016

|

01-Aug-2016

|

31-Aug-2016

|

|

201703

|

01-Mar-2017

|

31-Mar-2017

|

01-Jun-2016

|

30-Jun-2016

|

01-Sep-2016

|

30-Sep-2016

|

|

201704

|

01-Apr-2017

|

30-Apr-2017

|

01-Jul-2016

|

31-Jul-2016

|

01-Oct-2016

|

31-Oct-2016

|

|

201705

|

01-May-2017

|

31-May-2017

|

01-Aug-2016

|

31-Aug-2016

|

01-Nov-2016

|

30-Nov-2016

|

|

201706

|

01-Jun-2017

|

30-Jun-2017

|

01-Sep-2016

|

30-Sep-2016

|

01-Dec-2016

|

31-Dec-2016

|

|

201707

|

01-Jul-2017

|

31-Jul-2017

|

01-Oct-2016

|

31-Oct-2016

|

01-Jan-2017

|

31-Jan-2017

|

|

201708

|

01-Aug-2017

|

31-Aug-2017

|

01-Nov-2016

|

30-Nov-2016

|

01-Feb-2017

|

28-Feb-2017

|

|

201709

|

01-Sep-2017

|

30-Sep-2017

|

01-Dec-2016

|

31-Dec-2016

|

01-Mar-2017

|

31-Mar-2017

|

|

201710

|

01-Oct-2017

|

31-Oct-2017

|

01-Jan-2017

|

31-Jan-2017

|

01-Apr-2017

|

1-May-2017

|

|

201711

|

01-Nov-2017

|

30-Nov-2017

|

01-Feb-2017

|

28-Feb-2017

|

01-May-2017

|

31-May-2017

|

|

201712

|

01-Dec-2017

|

31-Dec-2017

|

01-Mar-2017

|

31-Mar-2017

|

01-Jun-2017

|

30-Jun-2017

|

|

201713

|

|

|

|

|

|

|

|

201714

|

|

|

|

|

|

|

|

201715

|

|

|

|

|

|

|

|

Where a Financial Year spans a calendar year, then it is normal that the Tourplan Calendar Year be the year of the Financial Period end. The cells in italics with a shaded background in the columns 01 Apr – 31 Mar and 01 Jun – 30 Jul in Table 1 Calendar Periods reflect that the financial year begins in the 2016 calendar year and ends in the 2017 calendar year.

|

|

Up to 15 Calendar Periods may be specified, but this should only be done on the advice of Tourplan Support. This facility enables a user company to change their balance date.

|

|

It is not uncommon for some companies to have their accounting periods in line with Airline accounting periods which generally consist of 13 x four weekly periods rather than 12 monthly periods.

|

Tourplan Accounting Principles

The Tourplan accounting system is different to the majority of "off-the-shelf" accounting packages, in that it has been designed specifically for the Tourism Industry. Unlike standard accounting systems which are predominantly transaction date based, the Tourplan accounting system offers the user a choice of transaction based, accrual based, or a mixture of both. This is because the Tourism Industry, in general (and dependant on local legislation), prefers to account for revenue in the month that travel takes place, rather than when the sales invoice(s) is raised, which can be quite some time prior to the month of travel.

Tourplan transactions have four accounting periods to them:

- Entered Period: the current accounting period at the date of transaction entry.

- Transaction Period: This is the period that the transaction is deemed to be in. This period can be different to the transaction entered period.

- Age Period: This is the period which will be the apply period of the transaction.

- GL Posting Period: the revenue/expense recognition period.

These accounting periods are determined by various INI settings. Because each transaction has these four periods stamped onto them, there is a great amount of flexibility in the accounting system's ability to handle a variety of accounting circumstances. With the exception of the Entered Period, the settings of each of the other 3 accounting periods is determined in consultation with the user company, depending on what their requirements are. In general, the periods can be set to be the System Date; the Travel Date; Last Service Date or the Last Date of the Current Accounting Period. There are some minor variations on these settings. Once the desired settings have been determined, they cannot be changed. The settings enable, for example, to post to the Debtors Ledger in the current period, age the debt in the Debtors Ledger based on the Payment Due date and post the revenue to the General Ledger (GL) Revenue Account in the period of travel. Tourplan automatically makes any accrual journals required and posts to Balance Sheet accounts any revenue or expense which is future dated and then automatically posts it to the correct revenue/expense account when the accounting period that the booking is travelling in is reached. The concept of the system making these journals automatically is quite unique and once it is understood, the transaction flow is quite simple to comprehend.

The entry of transactions for both Debtors and Creditors has been kept simple and consistent in both applications. All types of transactions can be performed from the one entry screen, and detailed information regarding any agent or supplier is instantly available. The accounting system is “Open Item” meaning that at each period end, only items (transactions) which are not completely balanced off are aged and brought forward into the next period.

Debtors and Creditors are sometimes referred to as Agents and Suppliers. They are the same thing, an Agent can also be called a Debtor and a Supplier can be called a Creditor. These Debtors and Creditors modules may also be called the Subsidiary Ledgers. For convenience, the Tourplan General Ledger module is often called the GL in this guide.

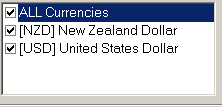

Agents and Suppliers can have multiple currencies attached to them and invoices (particularly to agents) can be issued in different currencies. The Tourplan Currency Rate table must be maintained with current exchange rates for this to occur effectively. Any foreign currency cash transactions (Debtor Receipts or Creditor Cheques) can have a current exchange entered against them at the time of transaction creation.

Tourplan has the ability to produce profitability figures on a per booking basis or on a group of bookings.

|

Tourplan does not (and cannot) post to the GL based on service type — e.g., Accommodation, Transport etc. The breakdown of revenue and expenses by type of service is an analysis function handled by the Tourplan Excel Reporting templates.

|

Invoices to agents for bookings must be issued either from within the booking or via the Bulk Invoicing utility in order to get the booking reference stamped onto the transactions. Invoices can be raised to agents/Debtors for non-booking related items from within the Debtors application, but bookings related invoices must be raised from within the Booking. Credit Notes against booking invoices already issued can be raised from within the booking as well as from within the Debtors module. Unless the automatic receipting function has been enabled, receipts for cash received can only be issued in the Debtors module.

Within the Creditors application, supplier invoices can be paid/part paid based on the voucher number that the system has allocated to the service. This provides the facility to match the payment value against the voucher value and the system will record any over or under payment. The Creditors application also allows payment to an alternate supplier—i.e., a supplier other than the one that the voucher was issued for. Non-booking creditors—utility companies etc.—can also have payments made to them.

All updating to the GL module is “On-Line”; that is, the GL postings are made when the subsidiary ledger transaction is created. If a subsidiary ledger transaction is altered or deleted, the relevant GL postings are similarly updated or deleted. Once a subsidiary ledger period is “closed”, then no further changes can be made to transactions.

The ability to provide booking by booking profitability figures is achieved using the Booking Reference which is attached to all bookings that are entered into the system. The booking reference is a combination of three components:

- Booking Branch: A 2 character code which is used as the highest level of analysis breakdown. Commonly set up as a distinction between Administration and Tours. More than one branch can be used to express Tours Revenue and Expenses. Examples used in this Training Guide are AD – Administration; OL – Online Sales; US – USA Office; NZ - N.Z. Office etc.

- Booking Department: A 2 character code used for the second level of analysis breakdown. This is normally a code which represents the type of booking, as well as separating out Administration/Overhead expenses. Examples used in this Training Guide are FI – F.I.T.; GP – Groups.; IN - Incentives; SH - Shore Excursions, AD – Administration etc.

- A 6 digit Booking Reference Number.

The booking references will, for example, be US FI 100123, indicating that the booking is (in this example system) a USA Office F.I.T. booking.

In addition to Branch and Department, 6 bookings Analysis Codes are available for further analysis. These are discussed in the System Setup Training Guide.

Each financial transaction that is created in either Creditors or Debtors for the booking is stamped with the booking reference and this enables the system to produce a report (via the Tour Window and Tour Financial Summary Reports) of profitability by booking. Further analysis exists using Microsoft Excel Report templates which can summarise the revenue and expenses for (e.g.) all US FIT bookings; or all US bookings or any combination of branch/department. All reporting at this level is performed in the base currency of the system.

The Tourplan Chart of Accounts is also based on the Branch/Department concept, and this allows the system to have commonality in certain account numbers, mainly Income and Expense accounts. If a user company elects to use (e.g.) account 010000 as its main Revenue Account, and (e.g.) account 020000 as the main expense account, then in the Tourplan GL Chart of Accounts, the following would be set up based on the example Branch/Departments used above:

Table 2: Sample Chart of Booking Revenue & Expense Accounts

|

Branch

|

Department

|

Account

|

Description

|

|

NZ

|

AD

|

010000

|

N.Z. Office Admin Revenue

|

|

NZ

|

FI

|

010000

|

N.Z.. Office FIT Revenue

|

|

NZ

|

GP

|

010000

|

N.Z. Office Groups Revenue

|

|

NZ

|

IN

|

010000

|

N.Z. Office Incentives Revenue

|

|

NZ

|

SH

|

010000

|

N.Z. Office Shore Excursion Revenue

|

|

OL

|

AD

|

010000

|

Online Sales Admin Revenue

|

|

OL

|

FI

|

010000

|

Online Sales FIT Revenue

|

|

OL

|

GP

|

010000

|

Online Sales Group Revenue

|

|

OL

|

IN

|

010000

|

Online Sales Incentives Revenue

|

|

OL

|

SH

|

010000

|

Online Sales Shore Excursion Revenue

|

|

US

|

AD

|

010000

|

U.S. Office Admin Revenue

|

|

US

|

FI

|

010000

|

U.S. Office FIT Revenue

|

|

US

|

GP

|

010000

|

U.S. Office Groups Revenue

|

|

US

|

IN

|

010000

|

U.S. Office Incentives Revenue

|

|

US

|

SH

|

010000

|

U.S. Office Shore Excursion Revenue

|

|

NZ

|

AD

|

020000

|

N.Z. Office Admin Expenses

|

|

NZ

|

FI

|

020000

|

N.Z.. Office FIT Expenses

|

|

NZ

|

GP

|

020000

|

N.Z. Office Groups Expenses

|

|

NZ

|

IN

|

020000

|

N.Z. Office Incentives Expenses

|

|

NZ

|

SH

|

020000

|

N.Z. Office Shore Excursion Expenses

|

|

OL

|

AD

|

020000

|

Online Sales Admin Expenses

|

|

OL

|

FI

|

020000

|

Online Sales FIT Expenses

|

|

OL

|

GP

|

020000

|

Online Sales Group Expenses

|

|

OL

|

IN

|

020000

|

Online Sales Incentives Expenses

|

|

OL

|

SH

|

020000

|

Online Sales Shore Excursion Expenses

|

|

US

|

AD

|

020000

|

U.S. Office Admin Expenses

|

|

US

|

FI

|

020000

|

U.S. Office FIT Expenses

|

|

US

|

GP

|

020000

|

U.S. Office Groups Expenses

|

|

US

|

IN

|

020000

|

U.S. Office Incentives Expenses

|

|

US

|

SH

|

020000

|

U.S. Office Shore Excursion Expenses

|

|

It is highly unlikely that the "Online Sales" branch would handle Group or Incentive bookings. The Branch and Department code setup (See the System Setup Training Guide) has checkboxes which allow a Branch/Department combination not to be able to be used in the FIT and/or Group booking applications. The Branch department combinations highlighted in Table 2 above, would have access to both of the booking applications turned off.

|

When the financial transactions are created (invoices to agents and payments to suppliers), the system obtains the correct Branch and Department from the booking to determine which Revenue/Expense account to post the transaction to.

The user company chart of accounts must be set up in the Tourplan General Ledger, and before accounting transaction processing can begin, as a minimum, the following accounts need to be set up:

Creditors

- Creditors Bank Account: The bank account to be used for the posting of Creditors’ cheque's.

- Creditors Control Account: Also simply known as “Creditors”—the total balances owing to Creditors.

- Expense Account(s): The accounts that booking and non-booking expenses are posted to.

- Future Expense: A “Payments to Suppliers in Advance” account.

- Future Expense Tax: For holding the tax value on Future Aged Creditors’ transactions.

- Creditors Future Cash: For holding Creditor’s cash which has been paid in advance of the Creditor’s invoice age period.

- Input Tax Account: Creditors VAT/GST account.

- Creditors Foreign Exchange Variations: For Creditors Forex variations to post to.

Debtors

- Debtors Unallocated Cash: This account is used to hold cash which has been received, but for which an invoice has not yet been issued.

- Debtors Bank Account: The bank account to be used for the posting of Debtors receipts. This can be the same as the Creditors Bank Account.

- Debtors Commission Account: The account that any commission paid to debtors is posted to.

- Debtors Control Account: Also simply known as “Debtors”—the total value owing by debtors.

- Revenue Account(s): The accounts that booking and non-booking revenue is posted to.

- Future Revenue: A “Deposits from agents in Advance” account.

- Future Revenue Tax: For holding the tax value on Future Aged Debtors’ transactions.

- Debtors Future Cash: For holding cash received in advance of the Debtors Invoice Age Period.

- Debtors Forex Account: For Debtors Forex Variations to post to. This can be the same as the Creditors’ Forex Account.

- Output Tax Account: Debtors VAT/GST account.

General

- Suspense Account: Used to hold any transaction posting for which a valid GL Account does not exist in the chart.

|

The Tourplan Suspense Account must be a Suspense Account being used specifically by the system. It must not be an account that will have sundry manual suspense transactions posted to it. If this occurs, reconciliation of the account is made much more difficult.

|

Chart of Accounts Structure

Naturally G.L. accounts other than those mentioned above will be required for a complete chart. The composition of the chart is entirely at the discretion of user companies, but there are some basic guidelines that will ensure the chart produces reports that are able to be easily read.

The most fundamental rule is to group accounts together by account type, by number. This is partially shown in Table 2 Sample Chart of Booking Revenue & Expense Accounts . An example chart could be constructed as follows: Not all accounts need to have a branch/department separation - it really only applies to those accounts where a profitability by branch and/or department is required.

Booking Specific Accounts

|

Booking Revenue

|

010000

|

|

Booking Expenses

|

020000

|

|

Booking Outstanding Vouchers

|

021000

|

|

Booking Agent Commission

|

022000

|

|

The Booking Outstanding vouchers account is debited and the Current Liabilites Outstanding Vouchers Accrual account is credited at the end of the accounting periods. This is a manual Journal, not an automatic system function.

|

Non Booking Specific Accounts

|

Other Revenue

|

Range 030000 - 039999. Bad Debts Recovered, Interest Received, Sundry Income etc

|

|

Administration Expenses

|

Range 040000 - 049999. Advertising, Bank Fees, Cleaning, Depreciation, Entertainment, Travel, Wages etc.

Forex Variations should also be in this range. In a standard system operating environment, one account per chart is permitted, however there are instances where multiple accounts can be used. Contact the local Tourplan support office for further details.

|

|

Current Assets

|

Range 050000 - 050999.Bank Account(s), Debtors Control (Agents), GST/VAT Intput Tax on Payables, A.P. Future Expenses, A.P. Future Cash, A.P. Future Tax on Future Expenses, Unallocated Cash etc

|

|

Investments

|

Range 051000 - 051999. Fixed Deposit, Long Term Investment, Shares in other Companies etc.

|

|

Fixed Assets

|

Range 053000 - 053999. Buildings, Land, Motor Vehicles, Office Equipment, Computers etc, Accumulated Depeciation (if used).

|

|

Other Assets

|

Range 054000 - 054999. Goodwill, Franchises etc

|

|

Current Liabilities

|

Range 060000 - 060999. A.R. Future Cash, A.R. Future Revenue, A.R. Future Tax on Future Revenue, Accounts Payable Control, Outstanding Vouchers (Accrual), Employment Taxes, Wages Clearing (Balancing) account etc.

|

|

Shareholders Current A/c's

|

Range 061000 - 061999.Opening Balances, Drawings, Insurances etc.

|

|

Term Liabilties

|

Range 063000 - 063999. Bank Loans, Mortgages etc.

|

|

Shareholders Funds

|

Range 065000 - 065999. Registered shares at face value, Retained Earnings..

|

|

Other Accounts

|

System Suspense Account. AD AD 999999.

This account is used by the System only. No manual transactions are to be entered into this account.

|

There will be other accounts specific to each user company. When these are created place them within the range of numbers allotted for their section.

Arranging the account numbers in a consecutive sectional fashion makes writing of Financial Reports much simpler and less time consuming. Accounts added in the future will automatically add to the Profit & Loss and Balance Sheet Reports.

|

The Tourplan GL INI settings must also be set up before transaction processing can commence. A list of the required settings is in the section on .

|

Accounting Documents

Tourplan has no pre-formatted invoice, credit note, cheque, remittance advice etc. documentation included. This enables user companies (with the assistance of Tourplan support if required) to customise documentation in their own format.

Any references in the pages that follow to fields that can be output on documentation does not mean that they will automatically be output. The fields will only be included on documentation if the design of the document allows for them.

(continued in Debtors Application)

Open topic with navigation

Debtors: for adding and changing agent details and entering agent transactions such as receipts, Credit Notes and non-booking invoices.

Debtors: for adding and changing agent details and entering agent transactions such as receipts, Credit Notes and non-booking invoices. Creditors: for adding and changing supplier details and entering supplier transactions such as invoices, Credit Notes and payments.

Creditors: for adding and changing supplier details and entering supplier transactions such as invoices, Credit Notes and payments. General Ledger: for setting up the chart of financial accounts, viewing account balances and inserting transactions.

General Ledger: for setting up the chart of financial accounts, viewing account balances and inserting transactions.