(continued from Foreign Exchange Variations)

If foreign currencies are not being used, this procedure does not need to be run.

Processing can only be run for either the current (open) period, or the last closed period—it cannot be run for periods in advance of the current period, nor for periods prior to the last closed period.

Forex processing can be performed on Debtors or Creditors at any time. When the processing is run during the open accounting period, any variations are deemed to Unrealised. When run for the closed period, the variations are Realised.

At period end, the normal Forex processing procedure is run for the closed period, and then run for the open period.

If necessary, separate GL accounts can be set up for Debtors Unrealised, Creditors Unrealised, Debtors Realised and Creditors Realised, but there can only be one account per type—i.e., there cannot be one account per branch and department for Debtors Realised; there can only be one Debtors Forex Realised account. This is because the Forex variations may have originated in bookings with different branch/department combinations, but they are bundled up by currency into one transaction amount, so cannot be split out to different posting accounts.

The General Ledger INI settings must hold the correct account information for debtors and creditors Forex accounts. It is not necessary to have separate accounts for realised/unrealised. If only one account is to be used, it must be set in the GL INI as the Unrealised account, not Realised.

A foreign exchange gain or loss occurs when there is an exchange rate difference between the invoice and cash (debtor’s receipt or creditor’s cheque) transactions.

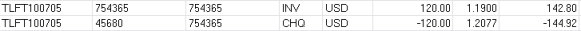

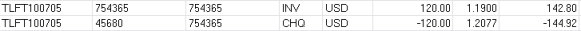

Screen Shot 33: Foreign Exchange Variation Example

In Screen Shot 33: Foreign Exchange Variation Example, invoice 754365 for USD 120.00 has been entered with the exchange rate (on the date of the invoice) of 1.19, giving a base (NZD) value of 142.80. When the cheque has been issued, the rate was 1.2077 which now gives a base (NZD) value of 144.92—an exchange variation of 2.12.

(continued in Forex Processing)