Open topic with navigation

(continued from Create a Banking Transaction)

Reconciliations

The Tourplan Bank Reconciliation has two main functions:

- Reconcile the Tourplan bank account(s) with actual bank statements.

- Produce a Bank Reconciliation report which shows an up-to-date balance for each bank account including any un-presented cheques/payments and any receipts not yet credited.

|

|

Advice should be sought from Tourplan before any use of the Bank Reconciliation is begun. This is because the initial reconciliation needs to be carefully thought through and if any errors or incorrect opening balance calculations have been made in preparing the initial data for entry, they may not be able to be corrected.

|

|

|

The Bank Reconciliation module must have been set up and initialised before statement reconciliations can begin. See Setup.

|

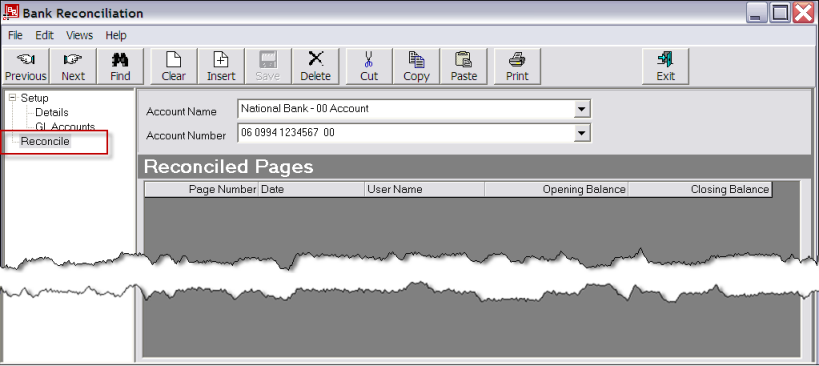

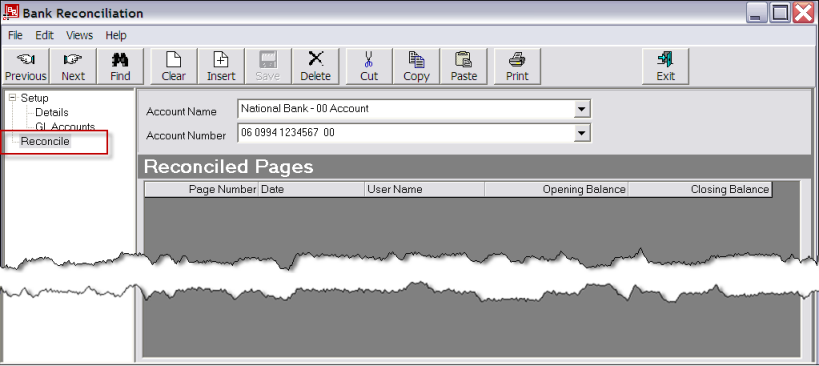

Screen Shot 46: Bank Reconciliation–Reconcile: Screen 1

The Bank Reconciliation is selected from Main Menu> Financials> Bank Reconciliation. Select the physical bank account to be reconciled from the Account Name or Account Number drop-down(s). The Bank Account Details screen (Screen Shot 40: Example Completed Bank Account Details) will display. Click Reconcile in the side bar menu, and the Reconciled s screen as in Screen Shot 46: Bank Reconciliation–Reconcile: Screen 1 displays.

Insert

To reconcile a bank statement , click the Insert button on the button bar.

|

|

The initialisation does not display in the Reconciled s screen.

|

|

|

The column headings at the top of this scroll are the only headings available for this screen.

|

|

|

All previous Bank Reconciliations for this bank account are shown in this screen. Only the last reconciliation can be edited and printed.

|

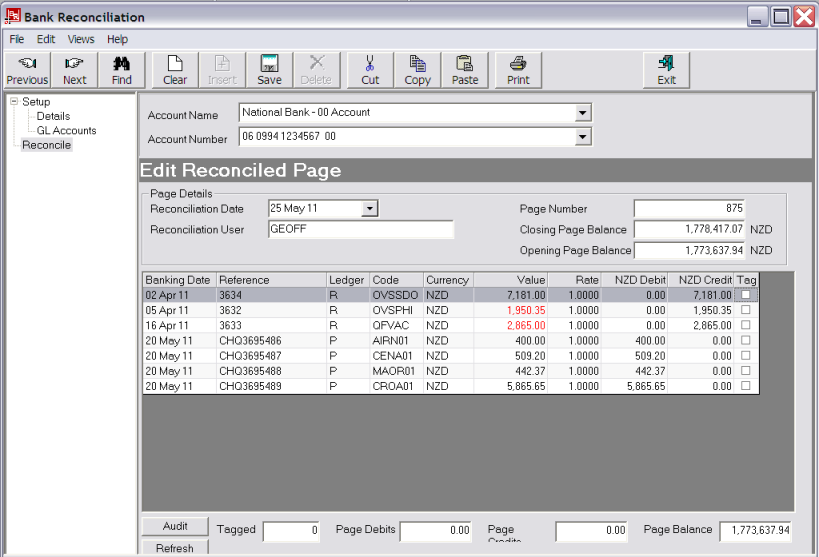

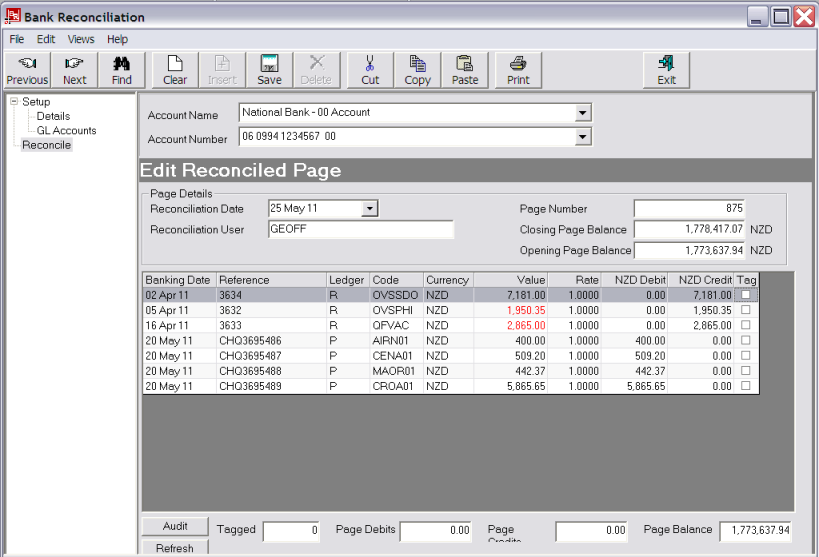

Screen Shot 47: Bank Reconciliation–Insert New

|

|

The column headings at the top of this scroll are the default headings for this screen. A full list of available scroll headings for this screen is found under the heading Bank Reconciliation Scroll.

|

Details

Reconciliation Date (Date)

This defaults to today’s date, but can be overridden to be the bank statement date.

Number (10 Chars)

The number automatically increments by 1 from the previous reconciliation number. This should match the number of the bank statement being reconciled. The Number can be edited, but only if the accounting period the reconciliation is in is an open period.

Reconciliation User (30 Chars)

This defaults to the current logged in user. It can be overridden to another user name if required.

ClosingBalance (Numeric, 16.2)

Enter the closing balance from the bank statement being reconciled.

OpeningBalance (Display Only)

The closing balance from the previously reconciled bank statement.

Transaction Scroll

With the exception of the Tag column, all fields are display only.

Banking Date

This either the transaction date or, if a Creditors/Debtors banking line, it is the banking date.

Reference

Either the transaction or Creditors/Debtors banking reference.

Ledger

This will display either Payables; Receivables, General Ledger or blank. It will be blank when the line is a Debtor’s or Creditor’s banking line. This is because GL transactions can be included in both Debtors and Creditors banking lines; this means that the ledger could be P and G or R and G.

Code

The debtor or creditor code. Blank for GL, Debtors and Creditors banking.

Currency

The currency of the transaction or banking.

Value

The value of the transaction or banking, in transaction/banking currency.

Rate

The exchange rate used in the transaction or banking.

NNN Debit

The debit amount in bank account currency.

NNN Credit

The credit amount in bank account currency.

|

|

The Debit and Credit columns relate to the Withdrawals and Deposits columns (or equivalent wording) on the bank statement. They do not indicate a Debit or Credit in the Tourplan GL bank account.

|

Tag (Checkbox)

To include a transaction or banking in the reconciliation—i.e., agree that it is on the bank statement—check the box on the end of the row.

Below the list of transactions are 2 buttons and 4 fields. These are:

Audit (Button)

When clicked, the currently highlighted transactions component lines will display.

Refresh (Button)

When clicked, the list of transactions will refresh and include any additional transactions.

Tagged (Display Only)

Displays the number of tagged transactions.

Debits (Display Only)

The total value of debit transactions on this reconciliation that have been tagged so far.

Credits (Display Only)

The total value of credit transactions on this reconciliation that have been tagged so far.

Balance (Display Only)

The Opening Balance plus the nett value of transactions tagged so far.

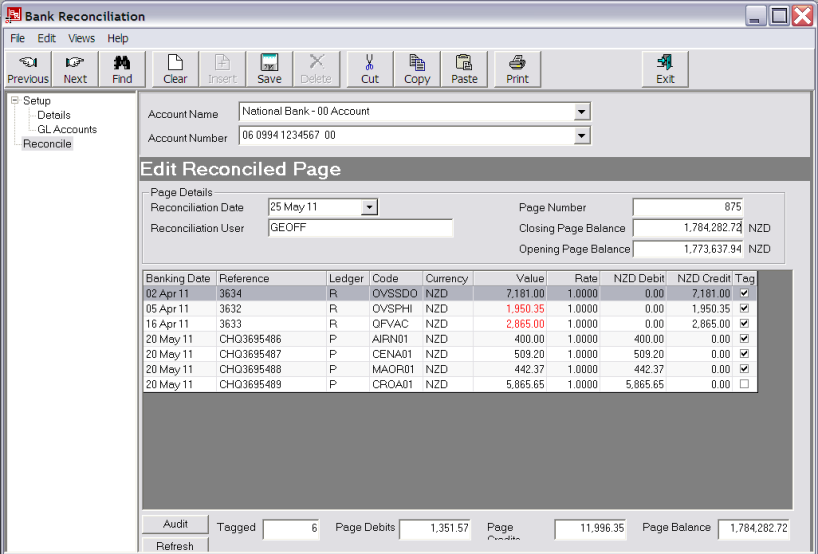

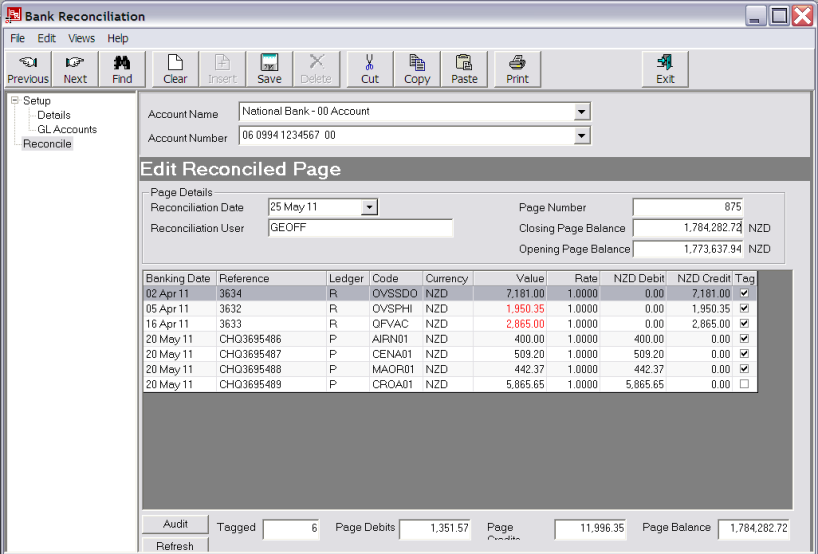

Screen Shot 48: Transactions Tagged for Reconciliation

Save

When all required transactions have been tagged, click the Save button on the button bar.

|

|

If the Details ClosingBalance does not equal the Balance, a warning message will display. The reconciliation cannot be saved unless these two figures balance.

|

When the reconciliation has been saved, the list of reconciled s re-displays.

The following rules apply when there is more than one reconciled :

- Only the last reconciled can be edited. Others can be viewed, but not edited.

- When a reconciliation is to be printed, the last must be included in the range of s selected—i.e., one historic reconciliation on its own cannot be printed.

To select multiple reconciled s for printing either:

- Click on the first to be printed, hold down the shift key and press the up arrow key; or

- Click and hold down the left mouse button and move the mouse pointer up.

The records will highlight to indicate they have been selected.

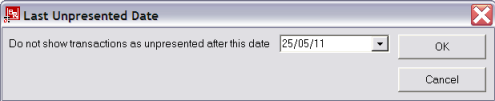

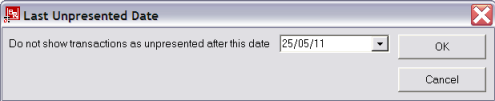

To print reconciliation, in the Reconciled s scroll, highlight the (s) to print and click the Print button in the button bar. The Last Un-presented Date dialogue displays.

Screen Shot 49: Last Un-presented Date Dialogue

Last Un-presented Date

Defaults to today’s date. This date can be changed. Any Tourplan transactions with a transaction date in the future will not be output on the Bank Reconciliation report. This date determines which transactions will appear in the un-presented section of the report—i.e. un-presented cheques and deposits not yet credited.

OK

To output the report, click the OK button on the dialogue.

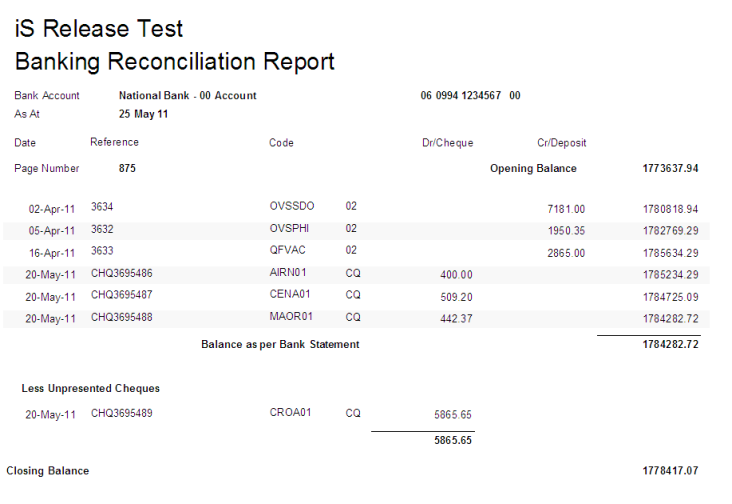

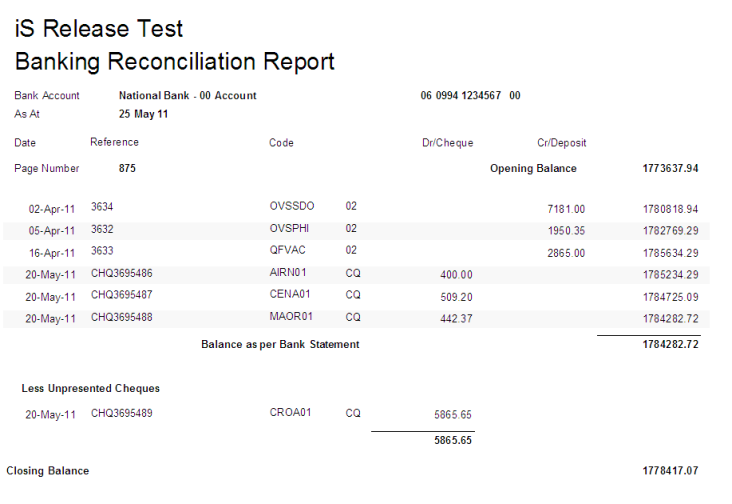

Screen Shot 50: Example Reconciliation Report

(continued in General Ledger)

Open topic with navigation